There are several things to consider when choosing the right accounting software for your small photography business. Utilizing accounting software tailored for photographers can significantly simplify these tasks and provide valuable insights into their business performance. To truly succeed and build a thriving photography business, photographers must also possess strong management skills. This article will explore various management tips that are essential… Additionally, it’s essential to consider the seasonality of your business. Photography businesses often experience fluctuations in demand throughout the year.

How do photography businesses keep track of expenses and income?

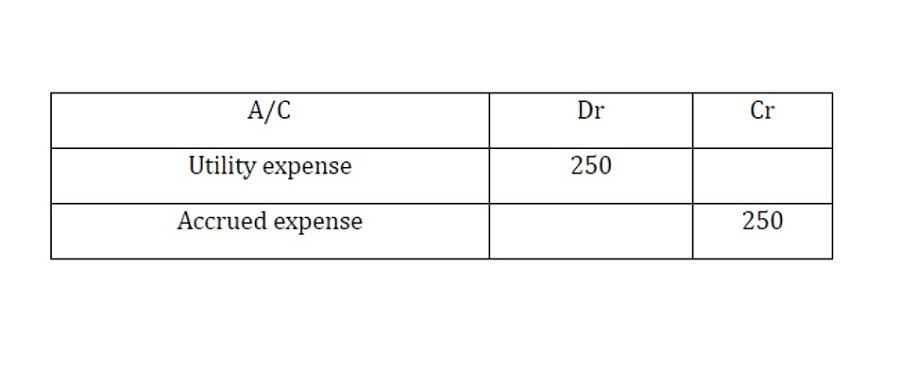

Equity capital specifies the money paid into a business by investors in exchange for stock in the company. Debt capital covers money obtained through credit instruments such as loans. An accounting cycle is an eight-step system accountants use to track transactions during a particular period. Because of the simplified manner of accounting, the cash method is often used by small businesses or entities that are not required to use the accrual method of accounting.

Your Data Is Accessible From Anywhere

We specialize in providing financial services exclusively for photographers like YOU! We offer various services, including online courses, full-service accounting, tax preparation, and business formation. Overall, selecting the most compatible and accurate accounting software is a crucial step for photographers looking to achieve a sustainable and successful business. By doing so, they can strike the right balance between managing their creative work and keeping their finances in check. Cloud-based software like StudioCloud can also integrate with your photography business’s CRM, making it easier to generate estimates and manage customer relationships. For small photography businesses, this level of integration can save both time and money.

Developing Your Pricing Model

- Further, you will have a much easier time sorting your books if all your business transactions are happening in one place.

- But you won’t see that transaction in your bank statements until April.

- Our customizable invoice, estimate and proposal templates will impress your clients!

- These adjustments allow others within the business to understand those projections’ potential impacts in relatable terms.

- To be successful, you also need to have a good understanding of business management.

- QuickBooks can provide photographers with a clear view of their finances, helping them to better manage their accounting and organizing their income and expenses.

Sprout Studio is the best accounting software with a photography-specific CRM that offers invoicing, client management, and scheduling tools. It helps photographers stay organized and efficiently manage their business. Accounting software provides photographers with a comprehensive solution to their unique financial challenges. By using such tools, photography businesses can better manage their finances, streamline their processes, and ultimately focus on their creative work. When selecting the best accounting software, photographers must consider their specific business needs, the size of their customer base, and their financial management goals. In conclusion, financial management is a crucial aspect of running a successful photography business.

Federal tax returns must comply with tax guidance outlined by the Internal Revenue Code (IRC). Luca Pacioli is considered “The Father of Accounting and Bookkeeping” due to his contributions to the development of accounting as a profession. An Italian mathematician and friend of Leonardo da Vinci, Pacioli published a book on the double-entry system of bookkeeping in 1494. At larger companies, there might be sizable finance departments guided by a unified accounting manual with dozens of employees. Let a local tax expert matched to your unique situation get your taxes done 100% right with TurboTax Live Full Service. Your expert will uncover industry-specific deductions for more tax breaks and file your taxes for you.

Understanding the Importance of Financial Management in Photography

Accounting software allows them to track client details, project information, and payment history in one place. This helps simplify communication, streamline project workflows, and maintain professional relationships. Implementing cost-saving strategies can significantly impact a photography accounting for photographers business’s bottom line. This may include negotiating prices with suppliers, leasing equipment instead of purchasing, and finding affordable marketing opportunities. By minimizing expenses without compromising quality, photographers can increase their profits and reinvest in their business.

- By 1880, the modern profession of accounting was fully formed and recognized by the Institute of Chartered Accountants in England and Wales.

- You probably have price packages and an hourly rate for ad hoc work, but do you know how much you really get paid per hour?

- You can review a breakdown of your recent jobs, quickly check how much you’re owed in outstanding invoices, review your potential leads, and determine the growth of your business, month by month.

- Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.

- At Bastian Accounting, we foster a Collaborative Partnership where clients are more than transactions; they’re valued partners.

Whether you’re seeking a loan or looking for investors, having a well-prepared financial forecast demonstrates your understanding of the market and your ability to manage your business effectively. For instance, a sole proprietorship is the simplest and most common form of business structure. It offers complete control and flexibility to the photographer, but also exposes them to unlimited personal liability. On the other hand, a partnership allows multiple photographers to join forces and share the responsibilities and profits, but it requires clear agreements and communication to avoid conflicts. It is important to track this information so that you can keep track of who owes you money and when they need to pay it. Let us show you why the best accounting software for small business is FreshBooks.

Who is Netsuite Accounting Software Ideal For?

FreshBooks is the most popular choice among the best accounting software for photographers when it comes to managing finances. It offers an intuitive and clean interface, time-tracking features, expense management, the creation of insightful financial reports, secure online payments, and invoicing capabilities. Photographers can easily manage their projects and clients while keeping track of their expenses. Flowlu was originally created for small businesses, and it works well as a free accounting software for photographers, too. The free version of Flowlu includes financial management tools like revenue, expenses, and payment tracking, as well as direct invoicing.

Home Office Tax Deductions

Nowadays, photography is a popular pastime and can be a wonderful hobby. It’s very fulfilling – which is the reason why so many people are trying to make it a central part of their lives. Many talented people have picked it up, either as a full-time job or as a side hustle. However, this deal of turning your favorite pastime into your job comes with strings attached.